A whole game

Readings and class materials for Tuesday, September 26, 2023

date_to_colname <- function(.data) {

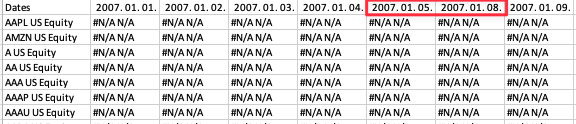

# * wide panel format > header are the dates started at 2nd col from 2017

dates <- seq.Date(

from = as.Date("2007-01-01"),

by = "days",

to = Sys.Date()

) |>

keep(~ lubridate::wday(., week_start = 1) %in% 1:5) |>

head(ncol(.data) - 1) |>

as.character()

.data |>

set_names(c("ticker", dates))

}bloomberg_raw <- list.files("../data/bloomberg", full.names = TRUE) |>

keep(str_detect, "/bloomberg_scores\\d{1,2}.xlsx") |>

map(.progress = "reading raw data", \(x) {

list(

news_heat = readxl::read_xlsx(x, sheet = 1, progress = FALSE) |>

date_to_colname(),

sentiment_avg = readxl::read_xlsx(x, sheet = 2, progress = FALSE) |>

date_to_colname()

)

})reading raw data ■■■■ 10% | ETA: 1mNew names:

New names:

reading raw data ■■■■■■■ 20% | ETA: 1m

reading raw data ■■■■■■■■■■ 30% | ETA: 1m

reading raw data ■■■■■■■■■■■■■ 40% | ETA: 1m

reading raw data ■■■■■■■■■■■■■■■■ 50% | ETA: 46s

reading raw data ■■■■■■■■■■■■■■■■■■■ 60% | ETA: 37s

reading raw data ■■■■■■■■■■■■■■■■■■■■■■ 70% | ETA: 27s

reading raw data ■■■■■■■■■■■■■■■■■■■■■■■■■ 80% | ETA: 18s

reading raw data ■■■■■■■■■■■■■■■■■■■■■■■■■■■■ 90% | ETA: 9s

• `` -> `...4274`

• `` -> `...4275`

• `` -> `...4276`

• `` -> `...4277`

• `` -> `...4278`

• `` -> `...4279`

• `` -> `...4280`

• `` -> `...4281`

• `` -> `...4282`

• `` -> `...4283`

• `` -> `...4284`

• `` -> `...4285`

• `` -> `...4286`

• `` -> `...4287`

• `` -> `...4288`

• `` -> `...4289`

• `` -> `...4290`

• `` -> `...4291`

• `` -> `...4292`news_heat_df <- bloomberg_raw |>

map_dfr(\(x) {

x$news_heat |>

pivot_longer(-1,

names_to = "time",

names_transform = ymd,

values_to = "news_heat") |>

mutate(

ticker = str_remove(ticker, " .*"),

news_heat = factor(news_heat, levels = 0:4, ordered = TRUE)

)

}) |>

drop_na()

news_heat_df# A tibble: 22,129,018 × 3

ticker time news_heat

<chr> <date> <ord>

1 AAPL 2010-02-16 0

2 AAPL 2010-02-17 2

3 AAPL 2010-02-18 1

4 AAPL 2010-02-19 0

5 AAPL 2010-02-22 2

6 AAPL 2010-02-23 3

7 AAPL 2010-02-24 2

8 AAPL 2010-02-25 4

9 AAPL 2010-02-26 3

10 AAPL 2010-03-01 4

# ℹ 22,129,008 more rowssentiment_avg_df <- bloomberg_raw |>

map_dfr(\(x) {

x$sentiment_avg |>

pivot_longer(-1,

names_to = "time",

names_transform = ymd,

values_to = "sentiment_avg") |>

mutate(

ticker = str_remove(ticker, " .*"),

sentiment_avg = as.numeric(sentiment_avg)

)

}) |>

drop_na()

sentiment_avg_df# A tibble: 31,270,528 × 3

ticker time sentiment_avg

<chr> <date> <dbl>

1 AMZN 2007-01-04 -0.500

2 AMZN 2007-01-05 -0.500

3 AMZN 2007-01-08 -0.500

4 AMZN 2007-01-09 -0.500

5 AMZN 2007-01-10 0.0555

6 AMZN 2007-01-11 0.0555

7 AMZN 2007-01-12 0.0555

8 AMZN 2007-01-15 0.0555

9 AMZN 2007-01-16 0.0555

10 AMZN 2007-01-17 0.0555

# ℹ 31,270,518 more rowsbloomberg_df <- list(

news_heat_df,

sentiment_avg_df

) |>

reduce(full_join, by = join_by(ticker, time)) |>

arrange(ticker, time)

bloomberg_df# A tibble: 34,499,579 × 4

ticker time news_heat sentiment_avg

<chr> <date> <ord> <dbl>

1 A 2007-01-05 <NA> 0.0506

2 A 2007-01-08 <NA> 0.0506

3 A 2007-01-09 <NA> 0.0506

4 A 2007-01-10 <NA> 0.0506

5 A 2007-01-11 <NA> 0.0506

6 A 2007-01-12 <NA> 0

7 A 2007-01-15 <NA> 0

8 A 2007-01-16 <NA> 0

9 A 2007-01-17 <NA> 0.558

10 A 2007-01-18 <NA> 0.319

# ℹ 34,499,569 more rows